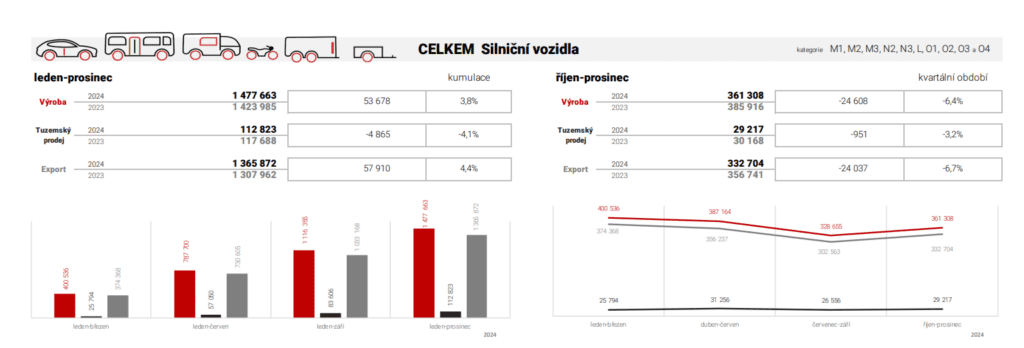

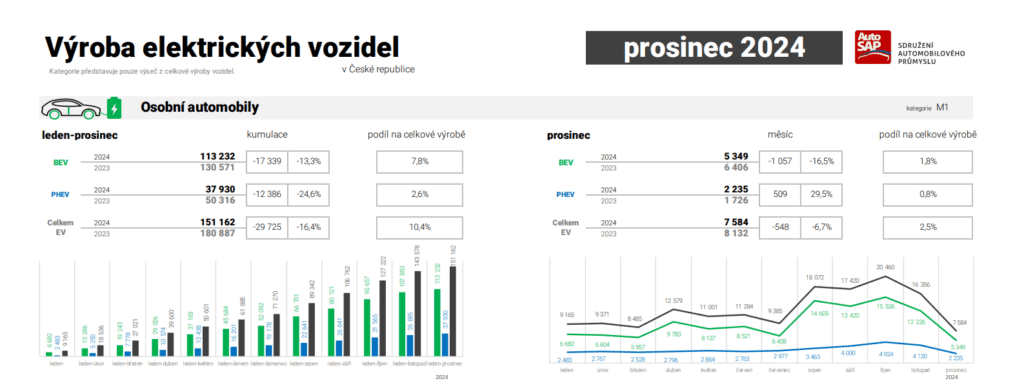

Despite a number of challenges, domestic automakers managed to increase production by 3.9 % year-on-year in 2024, reaching an all-time high of 1,452,881 passenger cars produced. Production of trucks 1,522 (+6.3 %), motorcycles 909 (+20.4 %) and trailers over 3.5 t with a total of 2,020 completed trailers and semi-trailers (+11.9 %) also improved. On the other hand, production fell in the categories of buses 4,489 (-14.5 %) and small trailers under 3.5 t 15,842 (-6.4 %). Electric vehicles accounted for 7.8 % of the total annual production of domestic manufacturers. 113,232 pure battery and 37,930 plug-in hybrid passenger vehicles and 245 pure battery buses rolled off the lines of domestic manufacturers in 2024. However, compared to the beginning of the year, the pace of vehicle production continued to slow at the end of the year.

"Despite deteriorating conditions, whether it is faltering supply chains, the negative impact of geopolitical conflicts, a sluggish economy or persistently high energy prices, the automotive industry has managed to achieve exceptional results in 2024. Total passenger car production in the Czech Republic increased by 3.9 % year-on-year to an all-time record of 1,452,881 passenger cars produced. These figures are clear evidence that the Czech automotive industry remains a key pillar of the domestic and European economy. It also shows that the growing regulatory pressure on the share of electric vehicles in sales comes at a time when customer interest in buying them is declining. This will further complicate the already complex environment that European regulation is creating for the industry in 2025. It is therefore essential that the European Commission takes the following steps in quick succession. Firstly, it should clearly declare that penalties for low EV uptake are counterproductive under the circumstances. Then, in the course of 2025, put forward a revision of the CO2 target system for vehicle manufacturers that will ensure genuine technology neutrality and give customers the choice of powering their vehicles. Thirdly, it will come up with a proposal for a real industrial policy that will promote the competitiveness of EU manufacturing in the face of global competition and will mean a reduction in the price of the vehicles purchased by consumers. The basis of such a proposal must be a review of the existing regulatory framework and the removal of the unintended negative effects of regulations that often cannot be met or are in conflict with each other. Conversely, another European regulatory marathon, as we have seen between 2019 and 2024, will not help the climate, the industry and, not least, the customer," Says Martin Jahn, President of the Automotive Industry Association (SAP).

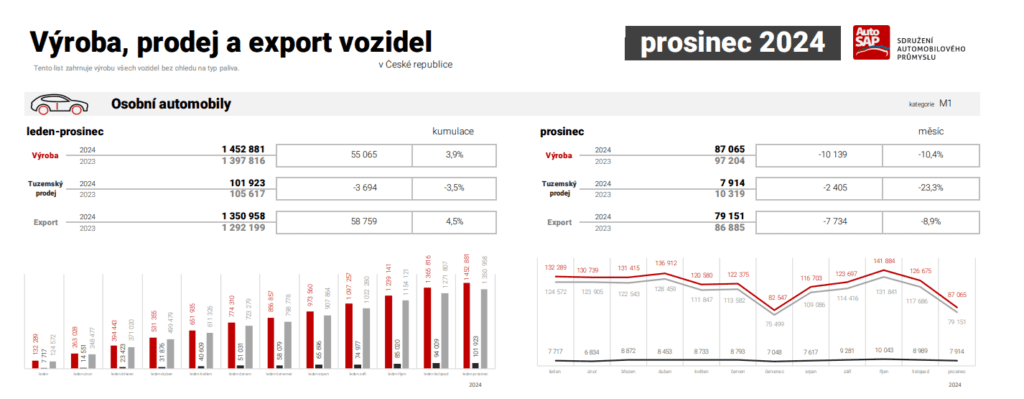

Passenger vehicles

In 2024, a total of 1,452,881 passenger vehicles were produced in the Czech Republic, i.e. 3.9 % more than in the previous year 2023. More than 93 % of the cars produced (1,350,958 units) went to foreign markets. Vehicle exports thus recorded a 4.5% increase year-on-year. A total of 101,923 vehicles were placed on the domestic market, accounting for 7 % of the total production. Compared to exports, domestic sales of passenger vehicles recorded a year-on-year decline, in this case by 3.5 %. Electric cars were produced from January to December with a total of 151,162 units, accounting for 10.4 % of domestic production. A total of 113,232 battery BEVs and 37,930 plug-in hybrids were produced. The electric vehicle segment thus recorded a year-on-year decline of 16.4%.

The largest domestic carmaker Škoda Auto, which accounts for 61.7 % of the total passenger car production in the Czech Republic, will produce a total of 896,933 cars (+3.7 %) at its domestic plants in 2024. 84,476 vehicles (9.4 %) were placed on the domestic market, while 812,457 vehicles (90.6 %) were destined for foreign markets. 96,534 electric vehicles (BEVs and PHEVs) were produced at the Mladá Boleslav plant from January to December, i.e. 10.8 % of the brand's total production. Of these, 79,932 were pure battery vehicles and 16,602 were plug-in hybrids.

Hyundai Motor Manufacturing Czech produced a total of 330,890 vehicles in the twelve months of 2024, i.e. 2.8 % less than in 2023. Of the total number of vehicles, 33,300 were pure electric and 21,328 plug-in hybrid. Overall, electric vehicles produced in Nosovice thus accounted for 16.5 % of the brand's total domestic production. More than 95 % (316,066 units) of the vehicles produced went to foreign markets, while the remaining 5 %, i.e. 14,824 vehicles, were placed on the domestic market. The total production of the Korean carmaker in the Czech Republic represents 22.8 % of the share of passenger vehicles produced.

A total of 225,058 complete vehicles rolled off the Toyota Motor Manufacturing line in Cologne in 2024, 32,631 and 17 % vehicles more than in the same period in 2023, which was affected by a series of shutdowns caused by suspended subcontracting of production components, particularly in the spring and summer months. The Cologne-based manufacturer accounted for 15.5 % of total passenger vehicle production in the country, with the Yaris HEV hybrid model accounting for half of its production.

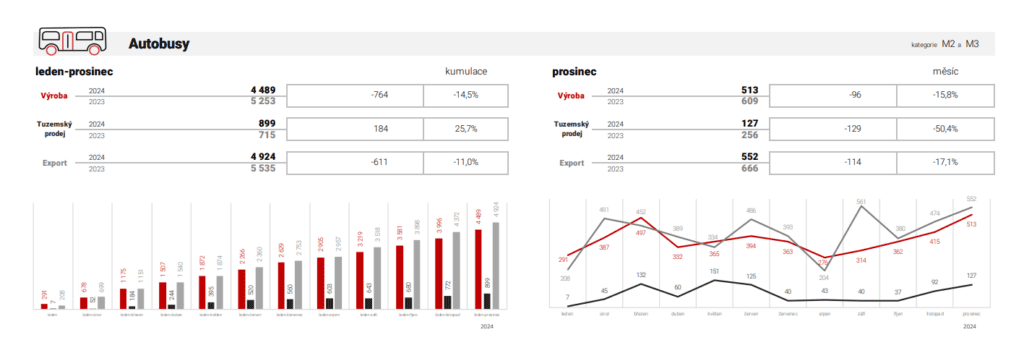

Buses

Bus production recorded a slight year-on-year decline, mainly due to the order-driven nature of production. In 2024, a total of 4,489 buses were produced in the Czech Republic, i.e. 764 fewer (-14.5 %) than in 2023. Of the total number of buses produced, 899 were destined for the domestic market (+25.7 %) and 4,924 were exported (-11 %). Iveco Czech Republic produced 4,040 buses (-14.8 %) and another 604 buses in built-up form, which are being completed at its sister plant in Foggia, Italy. The Libchavsky SOR plant also recorded year-on-year lower production results, with a total of 416 buses produced, i.e. 76 fewer than in 2023. More than 79.5 % of production, i.e. 331 buses of this brand, were produced domestically, while the remaining 20.4 %, i.e. 85 buses, were exported. On the other hand, KHMC recorded a higher production trend with 31 minibuses produced, 11 more than in 2023. A significant year-on-year increase (+744.8 %) was recorded in the segment of pure electric buses, of which a total of 245 units were produced in January-December. 193 of them rolled off the production lines of Iveco Czech Republic and 52 came from SOR Libchavy.

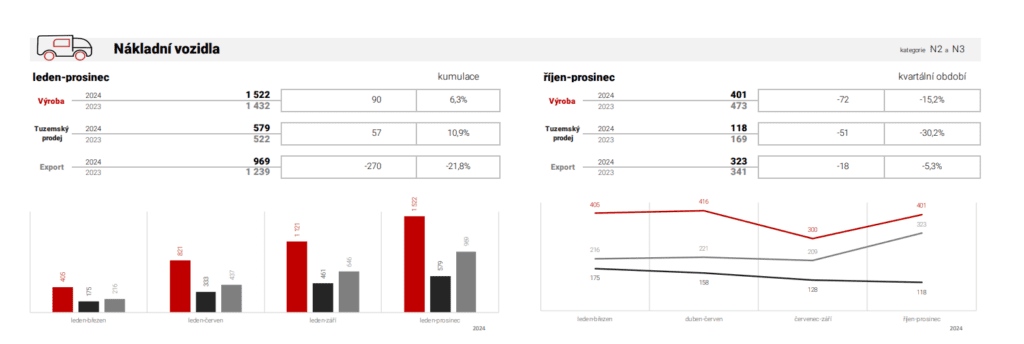

Trucks

Tatra Trucks, which is the only manufacturer of trucks among the members of the Association of the Automotive Industry, experienced another successful year. Year-on-year production increased by 90 units (+6.3 %) to a total of 1,522 trucks. Production of the Kopřivnice brand was directed both to export (969 units) and to domestic sales, for which 579 Tatra trucks were destined.

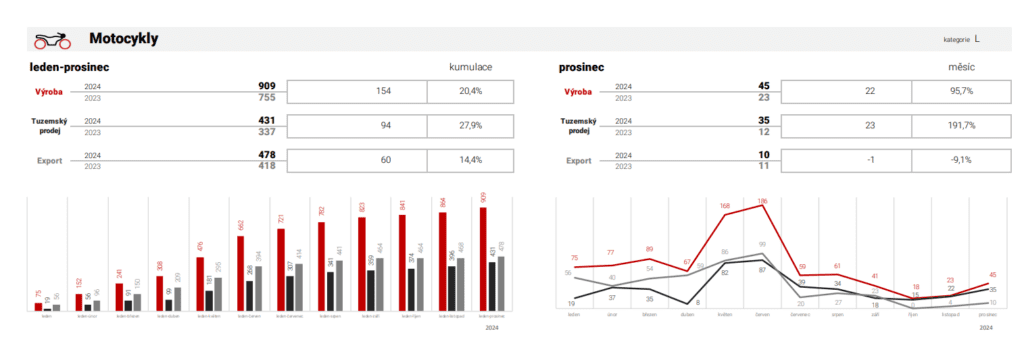

Motorcycles

Traditional motorcycle manufacturer Jawa Moto reported a year-on-year increase in production of 154 motorcycles (+20.4 %). In January-December 2024, a total of 909 motorcycles rolled off the production line of the domestic brand, of which 478 (52.6 %) were sent abroad and 431 (47.4 %) were sold in the Czech Republic.

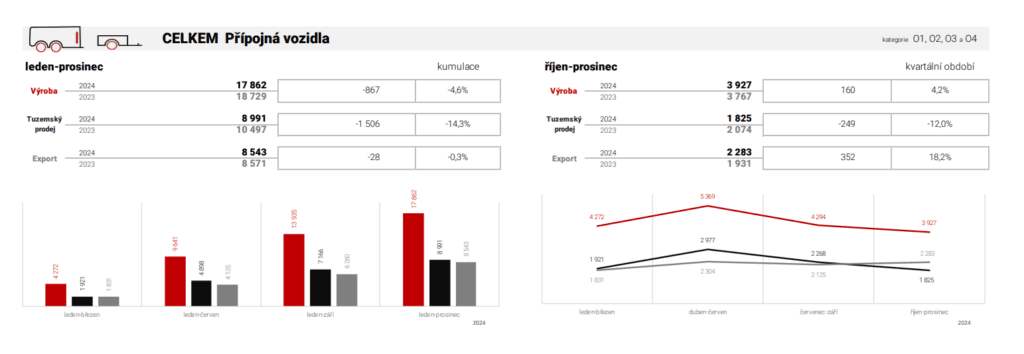

Trailers

In the trailer segment, 17,862 trailers and semi-trailers were produced from January to December, down by 4.6 % year-on-year. The overall decline in the segment was mainly due to Agados, which produces mainly small trailers up to 3.5 t. It produced a total of 15,842 units in 2024, 6.4 % less than in the previous year. In the Czech Republic, the company sold 8350 units (-9.5 %). In the segment of large trailers over 3.5 t, Agados produced 3 units. Panav, a manufacturer in the large trailers and semi-trailers segment, also recorded year-on-year lower production. It produced 489 large trailers (-5.2 %) in the Czech Republic. Of the total production, 419 trailers and semi-trailers were sold domestically and 67 for export. On the other hand, Schwarzmüller recorded higher year-on-year production results, with a total of 1,528 trailers and semi-trailers completed in 2024, 19.1 % more than last year. Of the brand's total production, 1,396 units went abroad and 220 units were sold domestically.

SAP/ gnews - RoZ

PHOTO - Facebook AutoSAP