It was enough for the D administration to. Trump's administration did not announce new tariffs for a few hours and the tension on the US markets could have dropped slightly. The news that the European Commission is postponing the introduction of retaliatory tariffs against the US until mid-April also contributed to this. This will create room for negotiations. This may also allow the dollar to retract its losses of recent weeks. Today, the US currency has appreciated slightly to 1.083 USD/EUR. Meanwhile, the US Fed kept its interest rates in the range of 4.25-4.50 % last night. This did not surprise anyone. Even so, investors concluded that the message from the US central bankers sounded dovish.

In the new forecast, the Fed raised its estimate of so-called core inflation, which excludes volatile food and energy prices, at the end of this year from 2.5 % to 2.8 %. The growth outlook for the US economy in 2025 has fallen from 2.1 % to 1.7 %. Although the Fed has worsened the growth forecast and raised the inflation estimate (in a stagflationary vein), it has made virtually no cuts to the interest rate projections for the next three years. It is true that a narrow majority of Fed officials continue to bet on a half percentage point rate cut for the rest of the year. That means two quarter percentage point rate cuts. What does that suggest? That from the Fed's perspective, the pro-inflationary shock coming from the tariff hike will be temporary. The implication is that the Fed will continue to pause in the process of cutting interest rates, but has no plans to extinguish the slightly elevated inflation in the US by returning to raising interest rates.

Another pigeon signal was that the Fed announced that it would step on the brake by reducing the pace of the Fed's balance sheet reduction (or so-called quantitative tightening). In order to avoid potential money market stress, the Fed intends to sell only $40 billion/month of bonds starting in April, when currently sales are at $60 billion/month.

It should also be remembered that the Fed will continue to keep a close eye on the hard data coming out of the US economy. According to Fed chief J. Powell, it is not getting dramatically worse so far. Even so, from Powell's point of view, the downturn in economic activity now poses a greater risk than any rise in inflation. The Fed is well aware that US households and businesses have some of their money invested in US equities. The Fed will not want to see more blood flowing in the equity markets. It will try not to let the stock markets add more losses in the tens of percent range after the 10% decline of recent weeks. In that case, they would try to calm the markets by further reducing the pace of balance sheet reduction or by cutting rates earlier as well. In this case, the Fed is lucky to have a dual mandate - in the form of 2% inflation and maximum employment. This means that the Fed sets its monetary policy to cover multiple objectives at once.

By contrast, the European Central Bank's job description is to focus mainly on inflation. Even so, I am betting that if the Fed were to start the process of cutting rates in order to avoid the US economy falling into recession, the European Central Bank would eventually copy this recipe. In its case, we are betting on a trio of 25 basis point interest rate cuts for the next 12 months. For the coming weeks, we are counting on the dollar to make up for the losses it has picked up in the last three weeks. Back in early March, the dollar was trading below USD/EUR 1.04 and was more than four cents stronger than today.

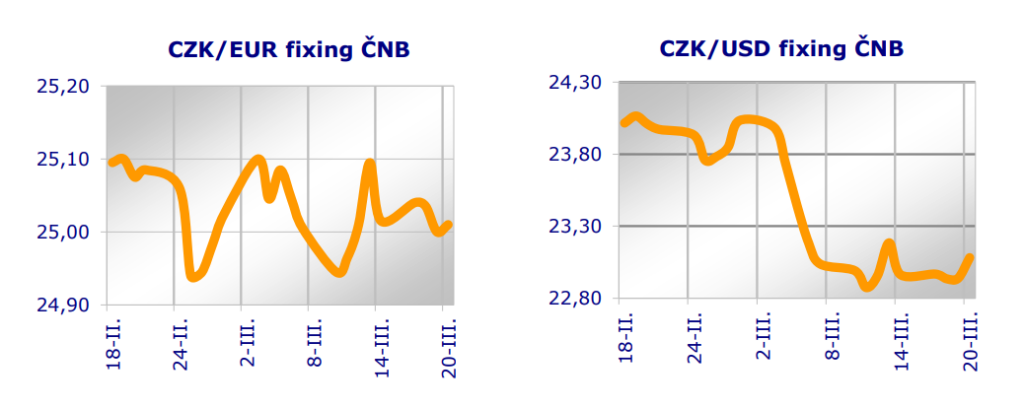

And what will the Czech National Bank do? New bank board member Jakub Seidler said this week that he would prefer to keep borrowing costs at current levels next week as European plans to increase defence spending increase domestic inflation risks. He is therefore not in favour of further rate cuts, and therefore of a further decline in the interest rate attractiveness of the crown. Unless the Czech National Bank rates do indeed go down, this should help the koruna to stay within sight of the 25 koruna per euro level for some time to come. Today the koruna is weakening slightly to CZK 25.01/EUR.

The Prague Stock Exchange is losing 0.4 % today. Slovak SAX index only stagnates

Jiří Cihlář, Markéta Šichtařová

Eurodeník 20. 3. 2025 Next Finamce s.r.o. Nextfinance.cz

AUDIO form can be found here