Foreign markets were waiting for US inflation figures. The market had tipped in advance that its annual rate would accelerate slightly, namely from 2.6 % to 2.7 %. And that is exactly what happened: The annual rate of consumer inflation in the US for November was 2.7 %.

The market had also accurately estimated how year-on-year core inflation would turn out. This does not include volatile energy or food prices. Year-on-year core inflation in the US remained at 3.3 %. So it is confirmed that we no longer see inflationary pressures easing in the US. On the contrary, we can observe a gradual pullback. And, of course, this is very reminiscent of Europe!

Such developments will hamper the Fed's interest rate cuts and credit cheapening in the future. It does not change the fact that now in December everything is pointing towards another slight cut in Fed interest rates. That is why the dollar is not making any significant gains today, strengthening only slightly to the level of 1.050 USD/EUR. In any case, today's statistics argue for a pause in the Fed's rate-cutting process to come early next year. This scenario is also supported by the fact that the current Fed chief, J. Powell, will remain in office until the spring of 2026. And as we know him, he will take inflation risks seriously.

There will also be a slowdown in the pace of Fed rate cuts because with the return of D. Trump to the White House in January next year, a number of changes can be counted on. The Fed will certainly be concerned about Trump's announced increase in import tariffs and therefore further upward pressure on prices in the US economy. The Fed's future caution in the process of cutting interest rates will be why the dollar will continue to remain strong. Let's not forget that as recently as late September, the dollar was seven cents weaker than it is today.

The Czech market is also dealing with price growth. Specifically, we are watching the echoes of yesterday's consumer inflation statistics. Its annual rate (to the surprise of the market and the Czech National Bank) did not rise, but remained at 2.8 %. This is net of volatile components such as energy or food. It was one tenth of a percentage point lower than forecasted by the Czech National Bank. Even so, central bankers suspect that inflation is not won, perhaps because of the brisk rise in service prices.

Member of the Board of Directors Jan Kubicek said yesterday that persistent inflationary pressures may be a reason to interrupt the interest rate cuts. That is why we are continuing to bet on a December pause in the Czech National Bank's interest rate cut process. The market has a similar view. Just look at the evolution of PRIBOR and forward-looking FRA rates. They show the market's conviction that the Czech National Bank will not cut interest rates before the end of this year. The resumption of the rate decline is expected to take place only at the beginning of next year.

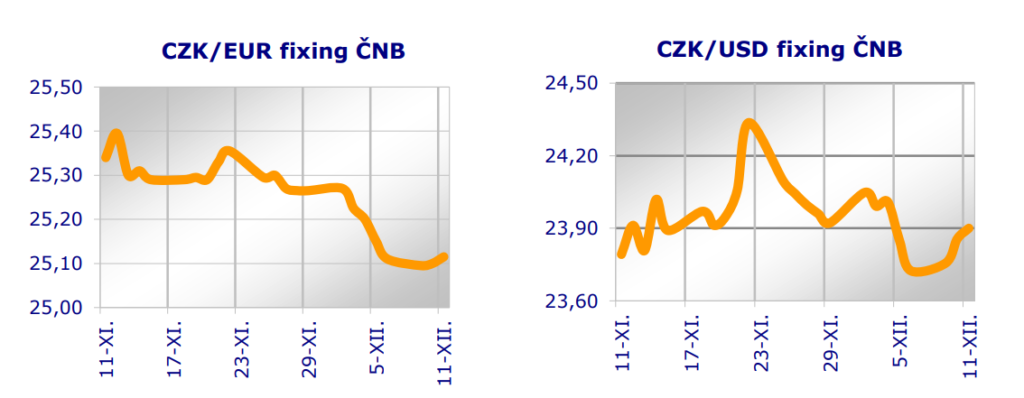

It is also interesting that expectations for the end of next year have changed. The market is no longer betting on such a rapid reduction in interest rates as before. In its last forecast, the Czech National Bank had expected the repo rate to fall from the current level of 4 % to 3 % by the summer of next year. According to the forecast, it should then stay there in the second half of next year. However, in our view, the reduction in interest rates (and also the cheapening of credit) will ultimately be slower. Therefore, the koruna should be slightly stronger at the end of next year than the Czech National Bank expects. We see the koruna at CZK 25.00/EUR in December 2025. Today, the koruna was basically stagnant at CZK 25.09/EUR.

The PX index of the Prague Stock Exchange rose by 0.1 % today, the Slovak SAX index stagnated.

Jiří Cihlář, Markéta Šichtařová

Eurodeník, 11. 12. 2024 Next Finamce s.r.o. Nextfinance.cz

AUDIO form can be found here

ILLUSTRATION PHOTO - pixabay