German car giant Volkswagen has announced concrete plans to close several of its production plants in Germany. Volkswagen's German auto union will advise members to go on strike from 1 December. Legitimately, Germany also found itself in a political crisis when the government coalition led by Chancellor Olaf Scholz broke up.

Moreover, Czech Prime Minister Fiala is also lashing out at Germany, promising to equalize Czech and German salaries within four years. (We estimate the probability of this scenario at 0.001 %.) Despite this economic and political turmoil, European politicians remain stubbornly insistent on the Green Deal and refuse to talk themselves out of achieving climate neutrality by 2050. Thus, many European companies are already over their heads in terms of costs. More than half of today's European industry could easily be gone by 2050. And to add to this, Russian President V. Putin is threatening a world war against countries that supply arms to Ukraine.

While European politicians continue not to retreat from their green positions, we do see tensions among central bankers. The closer we get to the next European Central Bank meeting, which is scheduled for 12 December, the more central bank representatives are changing their rhetoric. Even before the summer holidays began, the main concern of central bankers in the eurozone was inertial inflation. After returning from the holidays, they finally noticed that economic growth was somehow lacking not only in stagnant Germany but also in other eurozone countries.

Suddenly, the European Central Bank is starting to worry about leaving its interest rates too high. This could stifle what little economic growth remains in the individual euro area countries. The European Central Bank must be careful not to fall asleep when changing its course, as it did at the turn of 2021 and 2022, when inflationary pressures were clearly already building up. However, the European Central Bank kept interest rates at zero for a long time at that time with the excuse that the surge in inflation was only temporary. Eventually, the rate of inflation in the euro area peaked at 10.6 %.

The October meeting showed that the European Central Bank no longer needs to pause in the process of cutting interest rates. At that time, its deposit rate fell to 3.25 %. All indications are that further interest rate cuts in the euro area will not be delayed. Events overseas will also contribute to this. Donald Trump's victory in the US presidential election and the expected introduction of import tariffs will further cool economic growth in the eurozone. In driving parlance, the European Central Bank will attempt to downshift to neutral in the near future. Well, the neutral level of rates is at 2 % in the case of the European Central Bank. There, European Central Bank rates could fall as early as the middle of next year.

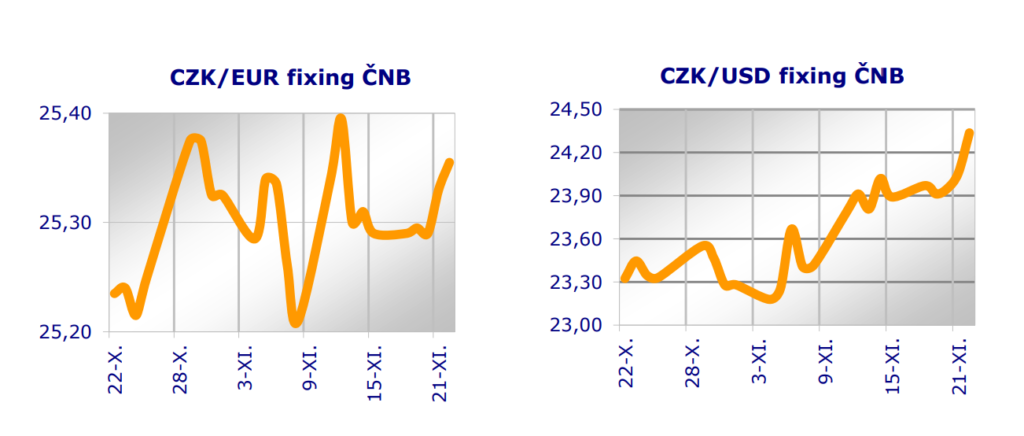

The euro (as the currency of the eurozone) and the dollar (as the currency of the US) are now pitted against each other. While European Central Bank interest rates will go down quickly, this will not be the case in the US. The introduction of import tariffs into the US will more or less inflate inflationary pressures in the US economy. This will hamper the Fed in the process of cutting interest rates. Still, a lot will depend on who Trump nominates for the new administration. Trump has picked billionaire Howard Lutnick, who until now ran the Wall Street brokerage and investment firm Cantor Fitzgerald, to be Commerce Secretary in his nascent administration. Lutnick has said that tariffs are a great tool at the president's disposal. So he, though a business man, cannot be expected to put the brakes on D's protectionist policies. Trump. The Fed will cut interest rates much more slowly than the European Central Bank for fear of rising inflationary pressures. The dollar is trading near the level of 1.040 USD/EUR. However, it briefly touched the level of 1.033 USD/EUR. At the time, it was the strongest it had been in two years. A widening dollar-euro interest rate spread will push the US currency to further gains.

The koruna was set to weaken today, but eventually reversed its losses. It is now trading at CZK 25.34/EUR. While the Czech stock index PX is growing by 0.4 % today, the Slovak index SAX is stagnant.

Jiří Cihlář, Markéta Šichtařová

Eurodeník 22. 11. 2024 Next Finamce s.r.o. Nextfinance.cz

AUDIO form can be found here

ILLUSTRATIVE PHOTO - Xinhua/Shan Weiyi