The Japanese yen and the Swiss franc are among the most traded currencies in the world. Perhaps surprisingly, however, they have much more in common. Both currencies are considered safe havens by investors. Investors turn to them in times of geopolitical uncertainty or financial turmoil because of their stability and low volatility.

This is based on the fact that both Japan and Switzerland have strong and stable economies. Japan is the third largest economy in the world, while Switzerland is known for its stable financial system. The Japanese and Swiss economies are then clearly linked by the fact that they have historically had low interest rates. Finally, both central banks in question - the Bank of Japan (BoJ) and the Swiss National Bank (SNB) - are known for not being shy about using foreign exchange market interventions from time to time to steer the exchange rates of their currencies.

Despite many similarities, however, the two currencies have recently differed significantly in one respect. That is the trend in their exchange rates. While the Japanese yen has been weakening in recent years, the Swiss franc has been strengthening in recent years.

While at the beginning of 2021 the dollar was available for 103 yen, it is currently 156 yen. Japan has long been struggling with economic stagnation and low inflation. This alone reduces the attractiveness of the yen. But what is crucial is how the central bank there responds. Japan has long had ultra-low interest rates. This became pronounced during 2022, when the US inflation rate started to rise. While the US Fed began to raise interest rates sharply at that time, interest rates in Japan continued to remain close to zero. Investors therefore made extensive use of the JPY for the carry trade. This process contributed to the depreciation of the JPY as investors borrowed JPY because of low interest rates in Japan and sold them to invest in assets in countries with higher rates. This process increases the supply of yen in the market, leading to its depreciation.

It was not until March 2024 that the BoJ ended its negative interest rate policy and raised short-term interest rates, but only just above zero to a range of 0 % to 0.1 1 %. At the time, the US Fed held rates above 5 %. In that situation, the yen's depreciation did not logically stop. When in July 2024 the JPY weakened against the dollar to its weakest value in 38 years, the Bank of Japan resorted to foreign exchange intervention. However, this only worked temporarily. The Japanese currency has been weakening again since about mid-September and has already lost much of the gains it made after the BoJ's summer intervention. As the dollar will continue to have a significant interest rate advantage over the yen, the long-term trend of the yen against the dollar will remain weakening.

The Swiss franc tells a different story. While in the spring of 2018 the franc was CHF 1.20/EUR, today it is CHF 0.93/EUR. Frank is pushing for a strengthening of a mixture of factors. The Swiss franc has always been considered a safe haven. There were several reasons why investors sought out safe havens, especially after 2020 - the pandemic, the conflict in Ukraine, high inflation and let's not forget the minor banking crisis in the spring of 2023. The Swiss central bank's actions to fight inflation were also behind the sharp appreciation of the franc. The annual rate of inflation peaked in August 2022 at 3.5 %. However, we certainly could not speak of any tragically elevated inflation in international comparison. In the US the inflation rate peaked at over 9 %, in the euro area it was close to 11 %. Swiss interest rates rose by 250 basis points to 1.75 % from summer 2022. They have stayed there for a long time even though inflation in Switzerland has fallen back below 2 %. At the time, the franc benefited from its greater interest rate attractiveness. Finally, we must not forget that the SNB resorted to foreign exchange intervention. The bank started pushing for an appreciation of the franc as early as June 2022 with the aim of reducing the price level by lowering imported inflation.

The year 2024 is different. The Swiss National Bank (SNB) has already cut interest rates three times this year and adjusted its forecasts for 2025 to 0.6 percent. But some estimates suggest that Switzerland could slide into deflation next year. The strong franc could be a significant contributor. There is therefore some scope for further interest rate cuts. However, given the threat of deflation, it would make sense for the SNB to target the appreciating franc directly through foreign exchange interventions. This may weaken the franc in the short term. The interest rate attractiveness of the franc should therefore slowly decline. This also suggests a decline in Swiss government bond yields. On the other hand, the European Central Bank is also in the process of cutting interest rates. The interest rate spread between the franc and the euro should therefore not change dramatically. That is why we are betting that, in the really long term, the franc will continue to strengthen against the euro.

Today we introduced two safe havens - the Japanese yen and the Swiss franc. If someone is not looking to do a carry trade, but wants to put money in one of these safe haven currencies for a longer period of time, we would bet on the franc. The reason is that the yen is at risk of further gradual depreciation.

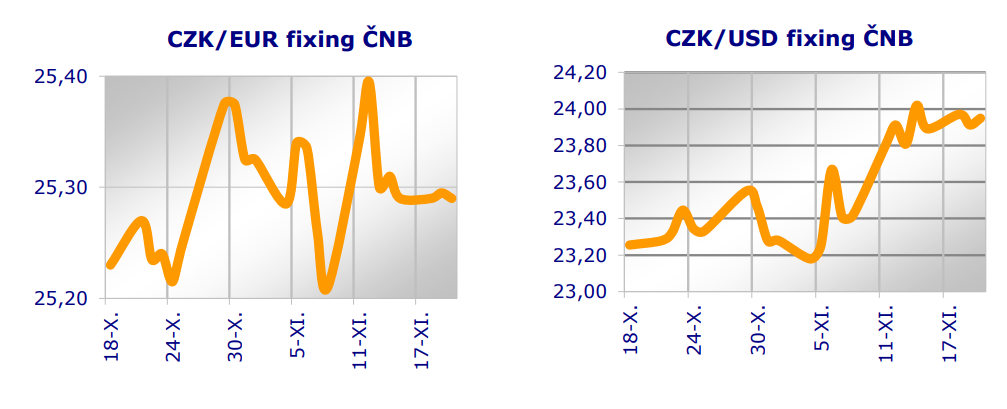

The koruna weakened slightly to CZK 25.30/EUR today. The dollar strengthened slightly to USD 1.056/EUR today.

Jiří Cihlář, Markéta Šichtařová

Eurodeník 20. 11. 2024 Next Finamce s.r.o. Nextfinance.cz

AUDIO form can be found here

ILLUSTRATIVE PHOTO - pixabay