Overview of the latest economic events in the Czech Republic

The economic climate in the Czech Republic was stable over the past 24 hours, with moderate growth in the manufacturing sector and stable consumer spending. The Czech National Bank signalled its intention to maintain interest rates, reflecting a controlled level of inflation and a supportive monetary policy. The koruna showed slight fluctuations against the euro, which were influenced by developments in global markets. Investor confidence continued to be supported by positive export data, especially to EU markets. In addition, the construction sector showed an increase in activity, suggesting increased domestic demand and potential infrastructure investment in the near future.

Latest trends on the Czech stock market and the inflow of foreign investment

Recent developments on the Czech stock market have shown a certain degree of cautious optimism among investors. In particular, blue-chip stocks showed moderate growth, driven by strong performances in the industrial and technology sectors. The Prague Stock Exchange saw increased activity, with investors closely monitoring global economic signals and domestic policy developments. Meanwhile, foreign investment inflows to the Czech Republic remained stable, with investors attracted by the country's strategic location and strong manufacturing base.

There is considerable interest from European and Asian investors looking for opportunities in sectors such as automotive, energy and digital infrastructure. Although geopolitical uncertainty and energy supply concerns continue to pose challenges, overall sentiment remains positive as investors keep a close eye on economic indicators and corporate earnings reports.

Current developments in the Czech real estate market and business environment

The Czech real estate market has recently shown signs of steady growth, driven by growing demand in both the residential and commercial sectors. Investors are particularly interested in Prague, where property prices are still rising due to limited supply and high demand. The business environment remains optimistic, with a stable economic environment supporting investor confidence. Government initiatives aimed at streamlining construction processes are expected to support continued development.

Overall, the Czech Republic continues to be an attractive destination for real estate investment, thanks to its strong economy and favourable regulatory framework.

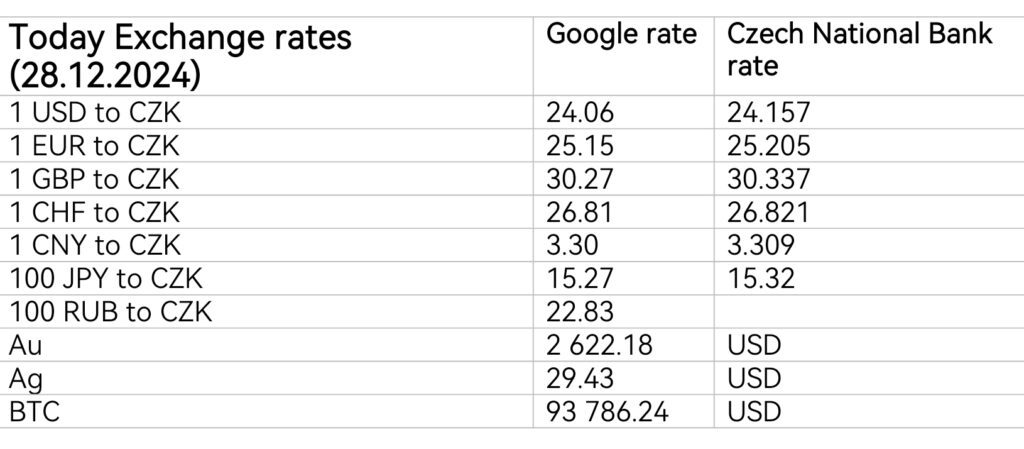

Overview of the main macroeconomic indicators from the Czech Republic: December 2024

HDP Q3 1,3%

Latest GDP forecast by the Czech National Bank: (annual GDP change)

2024: 1.0 %

2025: 2.4 %

2026: 2.4 %

Inflation rate

Average annual inflation (2023): 10.7%

Consumer price index (annualised) 2.8 %

Consumer price index (m/m) 0.1 %

Industrial producer price index (annual) 1.7 %

Market services price index (annual) 3.7 %

Construction work price index (annual) 2.5 %

Agricultural producer price index (annual) 5.5 %

Public finance deficit/surplus: CZK -3 513 000 000

Consolidated public debt: CZK 3 320 004 000 000

Population 2024/6: 10 879 069

Total number of economic operators 2023: 2 800 294

Number of economic entities with identified activity 2023: 1 668 516

Number of natural persons in business 2023: 1 968 473

GH

Sources:

Czech Statistical Office, official pages, access 28.12.2024

Official website of the Czech National Bank, accessed 28.12.2024

Czech National Bank - Monetary Policy Report - Autumn 2024 page 19, accessed 28.12.2024