Overview of the latest economic events in the Czech Republic

Ukraine's decision to stop the transit of Russian gas to Europe from 1 January 2025 represents a critical moment for the Czech Republic and the entire EU. Stopping the transit of Russian gas has far-reaching consequences and affects energy prices and supply chains across Europe. As countries move away from Russian energy, the Czech Republic's role in regional energy policy will be crucial. This measure increases the urgency of alternative energy sources and the move towards renewables. The Czech authorities are monitoring the situation closely, as the country remains highly dependent on energy imports. Initiatives to strengthen energy security, such as diversifying supply routes and promoting nuclear energy projects, are becoming a top priority. Collaboration with partners such as Rolls-Royce on small modular reactors underlines the Czech Republic's commitment to a sustainable energy transition. PSE's strong performance sets a positive tone for 2025, while changes in the companies indicate a readiness to embrace change.

The Czech Statistical Office published data indicating a slight decline in economic confidence, with the index falling to 97.5 points in December from 98.0 points in November. This decline reflects concerns about high energy costs and limited access to finance, which continue to make the business environment more difficult.

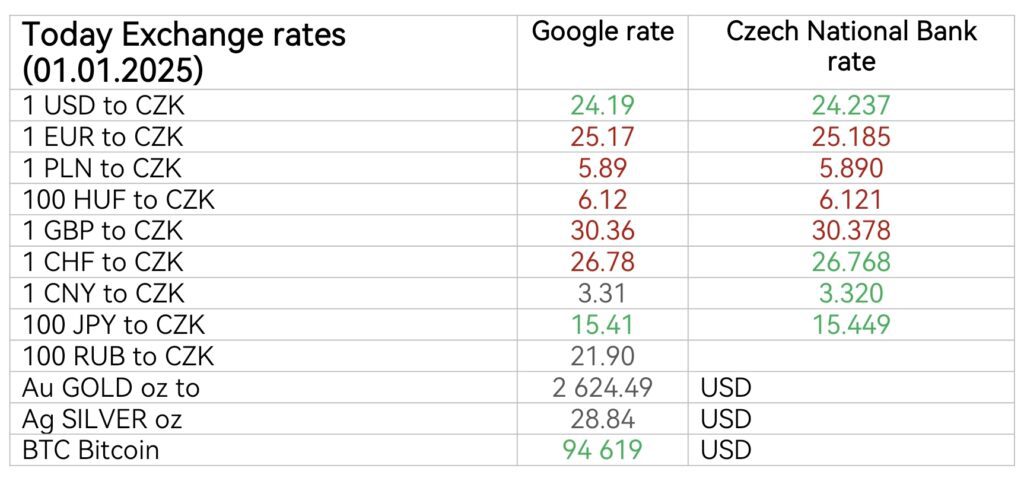

The CNB's decision to leave interest rates at 4.0 % has important implications for international investors and financial markets. By suspending the rate cut cycle, the CNB is signalling a cautious approach to monetary easing, which has implications for foreign investment flows and currency stability. This decision may affect investor sentiment towards emerging European markets and potentially influence capital allocation strategies globally.

Trends in financial markets: implications for the Czech economy

The Prague Stock Exchange ended the year with an impressive 25% gain, reflecting its resilience in the face of global volatility. Key players, including Erste Group and Kofola, led the growth thanks to strong financial results. While consumer goods and financial services drove the positive momentum, sectors such as utilities faced headwinds from volatile energy prices. The strong market performance underlines investor confidence in the Czech economy despite broader uncertainties.

Foreign investment trends: 24-hour overview

The Witkowitz Group has launched strategic acquisitions to strengthen its industrial capabilities and enhance its competitiveness in European markets. These moves are part of a broader trend of Czech companies adapting to global economic challenges through innovation and expansion.

In terms of corporate development, Czech energy company CEZ reported a net profit of CZK 23.4 billion (USD 984 million) for the first three quarters of 2024, a 27.3% decrease compared to the same period last year. The decline is due to lower profits in the trading and mining sectors. Despite this, CEZ continues to pursue its strategic initiatives, including plans to build two new nuclear reactors and a collaboration with Rolls-Royce SMR to develop small modular nuclear reactors.

Moreover, CEZ's cooperation with Rolls-Royce SMR on the development of small modular nuclear reactors underlines its commitment to the development of nuclear power technology. The aim of this partnership is not only to strengthen the Czech Republic's energy infrastructure, but also to contribute to the global debate on sustainable and safe energy solutions. The development of modular reactors could influence energy markets worldwide and offer a scalable and potentially more efficient alternative to traditional nuclear power plants.

Poverview of main macroeconomic indicators from the Czech Republic: december 2024

HDP Q3 1,3%

Latest GDP forecast by the Czech National Bank: (annual GDP change)

2024: 1.0 %

2025: 2.4 %

2026: 2.4 %

HDP: 342 990 000 000 USD

GDP per capita: 31 370 USD

GDP purchasing power parity: 619 000 000 000 USD

Average gross wage Q3 2024: 45 412 CZK (+7%)

Interest rate (December 2024): 4%

Inflation rate - consumer price index (annual) 2.8 %

Inflation rate - consumer price index (month-on-month) 0.1 %

Average annual inflation (2023): 10.7% (2022: 15.7%)

Industrial producer price index (annual) 1.7 %

Market services price index (annual) 3.7 %

Construction work price index (annual) 2.5 %

Agricultural producer price index (annual) 5.5 %

Money supply M3 (October 2024): 7 002 614 320 000 CZK

Money supply M3 (2002): CZK 1 339 928 850 000

(M3 reflects the total amount of money in circulation in the economy)

Deficit/surplus of public finances Q2 2024: -3 513 000 000 CZK

Consolidated public debt Q2 2024: CZK 3 320 004 000 000

Population 2024/9: 10 897 237

Total number of economic operators 2023: 2 800 294

Number of economic entities with identified activity 2023: 1 668 516

Number of natural persons in business 2023: 1 968 473

GH

Sources:

Czech Statistical Office, official website accessed 1.1.2025, https://csu.gov.cz/

Czech National Bank, official website, accessed 30.12.2024, https://www.cnb.cz/

Czech National Bank - Monetary Policy Report - Autumn 2024 page 19, accessed 28.12.2024

International Monetary Fund, official website, accessed 30.12.2024, https://www.imf.org/

photo: peak.cz