The year 2024 can be described as the first fully post-crisis year in the European Union's energy sector. Few periods have affected the European energy sector as much as 2021 to 2023. Electricity and gas consumption fell significantly in these years, due to record high commodity prices. It was only during 2024 that they stabilised at levels that are likely to remain for some time. How the energy sector will develop in 2025 remains to be seen, but we already know that there are a number of uncertainties that may affect the daily lives of the Czech population.

What is happening on the European energy markets and in the Czech energy sector is of increasing interest not only to experts but also to the general public. In recent years, the energy sector has been undergoing a major transformation, affecting not only companies but also households. In public debate, in business, but also in conversation among people outside the industry, it is now common to encounter topics such as the shift away from coal, the construction of new nuclear sources or the boom in photovoltaics.

Report is a collaboration between the analytical portal oEnergetice.cz and the comparison website Ušetřeno.cz and therefore aims to summarize the development of the Czech energy sector over the last year in data and offer readers an explanation of the main milestones and their impact on companies and households. It helps to better understand how the much-discussed transformation of the energy sector is affecting the end consumers who are our readers and users.

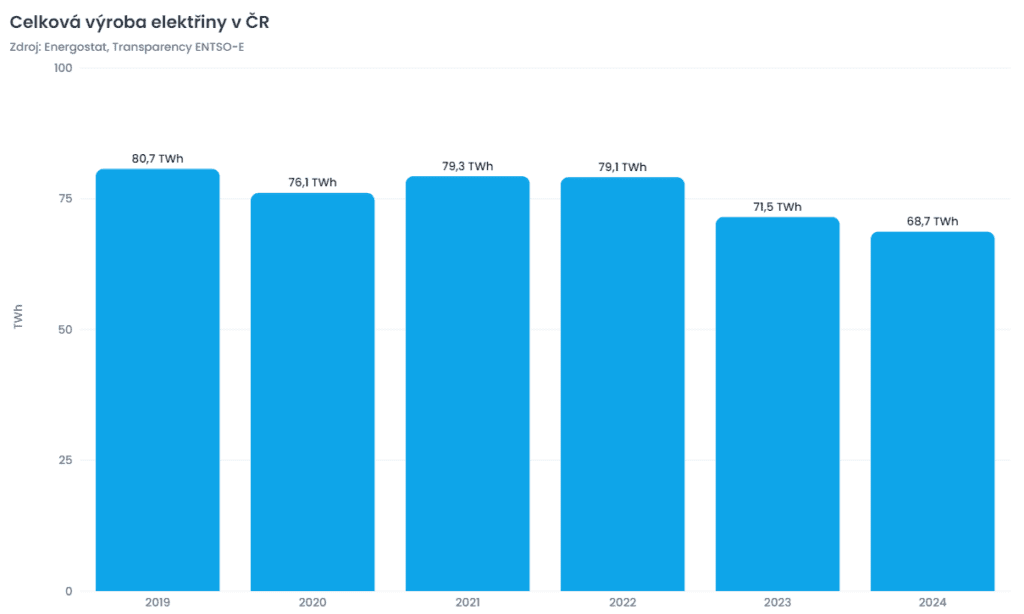

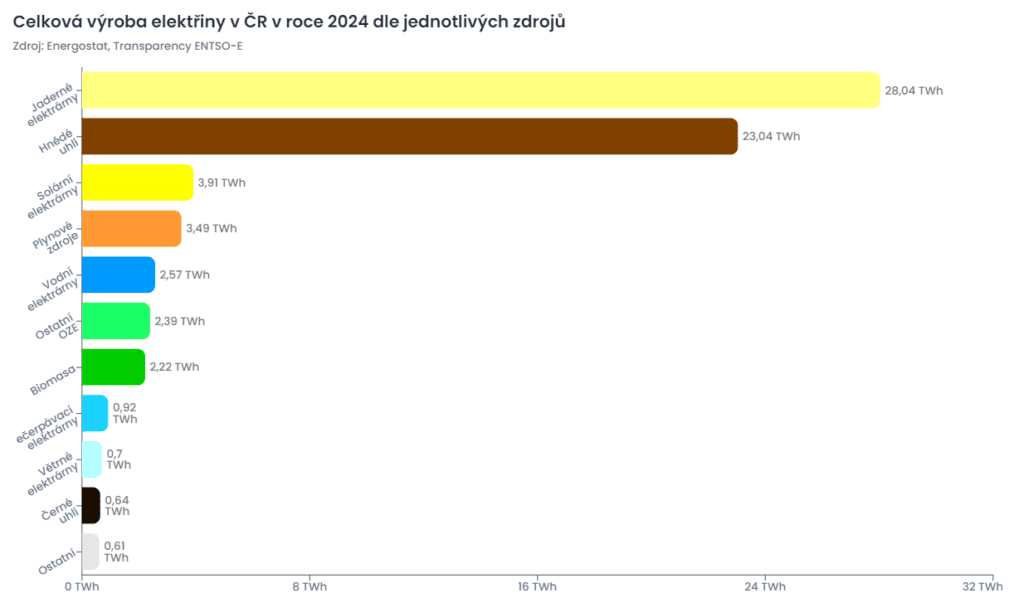

Total electricity production in the Czech Republic recorded a second consecutive year-on-year decline, this time by about 4 %. Czech sources produced a total of 68.7 TWh in 2024. This decrease was mainly due to lower production in coal-fired power plants, with lignite plants producing around 8 % less electricity and coal-fired plants even 64 % less electricity than in 2023. Production in nuclear power plants also decreased, with 2 % less electricity delivered to the grid year-on-year. On the other hand, the production of solar power plants increased significantly, producing 40.5 % more electricity than in 2023 thanks to the increase in installed capacity, according to ENTSO-E data.

Electricity generation has also dropped significantly compared to crisis years, falling by almost 15 % last year compared to pre-pandemic 2019. The decline in generation was largely due to a continued reduction in domestic electricity consumption and a reduction in electricity exports abroad, which fell by about a third for the second year in a row.

Nuclear and lignite sources have traditionally been the largest sources of electricity in the Czech Republic, accounting for 40.8 and 33.5 % of total electricity production, respectively. Solar power plants came in third place, increasing their production for the second year in a row. With a share of 5.7 % in total electricity production and a year-on-year increase in production volume of more than a third, they surpassed gas-fired sources, which accounted for 5.1 % of total production. The next ranks with a share of between 3-4 % in total production were occupied by hydroelectric power plants, other RES and biomass.

Summary

- Total electricity generation in the Czech Republic recorded a significant year-on-year decline for the second consecutive year in 2024, this time by around 4 %. This decline was mainly due to lower generation from coal-fired power plants.

- In the crisis year 2022, coal-fired power plants still delivered more than 33 TWh of electricity to the grid, compared to less than 27 TWh in 2023 and less than 24 TWh last year.

- The controllable output of coal-fired power plants should be replaced in the future by new gas-fired thermal and power plants. According to the outlook of the transmission system operator, ČEPS, electricity production from these sources could increase up to threefold by 2035.

- Net electricity consumption last year reached 57.9 TWh in round figures. Total electricity consumption in the Czech Republic stagnated in 2024, continuing the downward trend of previous years.

- Consumption in 2024 remained below pre-pandemic (2019) levels, reflecting ongoing trends in savings and changes in industrial and domestic consumption. Thus, overall, stabilization can be observed after previous significant declines, but at a lower level than in the past.

- The Czech Republic will export 7.68 TWh and import 1.26 TWh of electricity in 2024. Electricity production in the Czech Republic exceeded consumption in 6,732 hours, while the remaining 2,052 hours were partially covered by foreign sources.

- The net export position of 6.43 TWh is the lowest in at least 10 years and 30 % lower than in 2023. The declining export position suggests that the Czech Republic may become a net importer of electricity in the coming years.

- From the perspective of wholesale energy markets, 2024 was not as turbulent as the previous period from 2021 to 2023, but there is no question of a complete calm.

- Long-term contracts were mainly exposed to the impact of fuel prices, especially natural gas, and emission allowances, which reacted to geopolitical developments and ongoing conflicts, including the war in Ukraine and developments in the Middle East. Short-term markets were affected by the continued growth in installed capacity in renewable energy sources, with a sharp increase in the number of hours with zero or negative electricity prices.

- Renewable energy continues to be the fastest growing source of electricity. The growth is mainly driven by solar power plants, with a total of 967 MWp of installed capacity in 2024. Thus, the country's solar power capacity recorded an increase of approximately 28% in installed capacity to a total of 4430 MWp.

- The year 2024 has brought a number of legislative changes and innovations to help the further development of RES. In addition to the launch of the Electricity Data Centre, which provides the possibility of electricity sharing, the Lex RES 3 is expected to be approved at the beginning of the year, which should finally introduce accumulation and flexibility into Czech legislation. Mention can also be made of the methodology introduced for the introduction of acceleration zones and the associated acceleration of the permitting process for power plants with larger installed capacity. The MIT will also try to support this type of power plants by announcing operational support during 2025-2027 for up to 350 MW of new installed capacity per year.

- As the installed capacity of RES grows, the number of hours with negative or zero electricity prices is also growing, with 2024 being a record year in this respect, with 361 hours. This is thus a problem that new installations will have to deal with. In addition to negative electricity prices, strengthening the electricity system, and especially the distribution system, whose capacity is exhausted in most places in the country, is also a challenge.

- In 2024, both power and gas prices were falling in acquisition offers to new customers. According to Ušetřeno.cz, the largest domestic comparator, the average price of the commercial component of electricity (power electricity) decreased from CZK 3,401/MWh excluding VAT in January to CZK 2,667/MWh excluding VAT in December. The price of gas fell from CZK 1,429 to CZK 1,117 per MWh excluding VAT over the same period.

- According to data from Ušetřeno.cz, the average savings from switching electricity suppliers in 2024 amounted to approximately CZK 5,000 per year, and around CZK 7,000 per year for gas.

- According to OTE, there will be a total of 579,344 changes of electricity supplier and 204,696 changes of gas supplier in 2024.

oenergetice.cz/ gnews.cz - RoZ

ILLUSTRATIVE PHOTO - pixabay