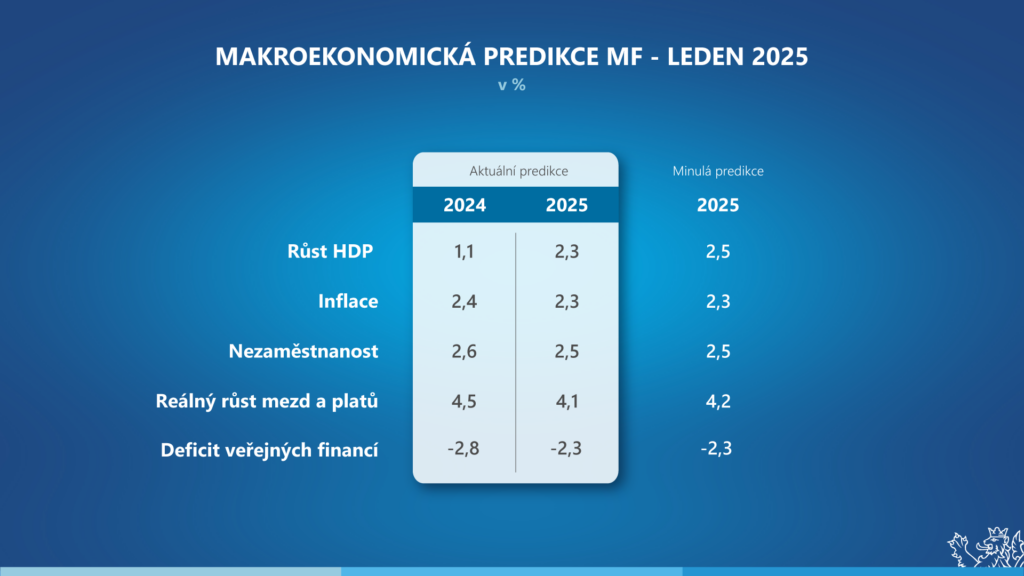

The Czech economy returned to growth last year, which will accelerate by more than a percentage point to 2.3 % this year, according to the new macroeconomic forecast of the Ministry of Finance of the Czech Republic. Annual inflation is expected to be close to 2 % throughout this year. Thanks to persistent labour market tightness and falling inflation, real earnings will rise.

"Higher real wage growth also means higher household consumption. It is this rising consumption, as well as the recovery in investment, that will contribute to the Czech economy growing by 2.3 % this year. The update of our macroeconomic forecast itself does not imply any substantial changes to the estimate of tax revenues for the state budget," said the Minister of Finance Zbyněk Stanjura on the new economic outlook.

"The ongoing structural problems of our main trading partner, Germany, remain a risk. The new US administration's trade policy towards the European Union will be crucial for the domestic export-oriented industry," Minister Stanjura added.

Gross domestic product for the full year 2024 is likely to increase by 1.1 %. The unwinding of high inflation has translated into an increase in real household incomes and household consumption expenditure. Investment activity has been dampened by persistent problems in euro area countries and the transition between financial perspectives for EU cohesion funds. A slight reduction in total investment and a fall in inventories held back import dynamics, and the external trade balance supported economic growth. In 2025, economic growth is expected to be boosted mainly by household consumption and investment spending, and GDP could be 2.3 % higher year-on-year.

Average rate inflation reached 2.4 % in 2024 and is expected to fall slightly further to 2.3 % this year.Inflationary pressures were significantly lower last year than in the previous two years - inflationary external supply factors weakened significantly and domestic demand pressures were further dampened by higher monetary policy rates and the fiscal consolidation package. This year, inflationary pressures will continue to be moderated by restrictive monetary policy combined with an expected decline in the dollar oil price and a slight appreciation of the koruna against the euro. By contrast, inflationary factors will be continued higher wage growth, the weakening of the koruna against the dollar, increased price dynamics in services and renewed imputed rent growth.

At labour market imbalances related to labour shortages continue to manifest themselves. As a result, the unemployment rate could remain at 2.6 % in 2024 despite the weak economic momentum. It could fall slightly to 2.5 % this year due to economic growth. The persistent tightness in the labour market will not allow a significant slowdown in wage and salary growth. Real earnings are expected to increase by more than 4 % this year as well.

Government deficit probably fell by 1 pp to 2.8 % of GDP last year, despite increased defence spending, higher pensions or flood recovery costs. The government's consolidation efforts should be reflected in the general government outturn this year as well, when we forecast a reduction in the deficit to 2.3 % of GDP. General government debt reached an estimated 43.4 % of GDP at the end of last year and is expected to exceed 44 % of GDP this year.

Prediction risks we consider them to be biased downwards in aggregate. Economic activity in some sectors of the economy may be dampened by renewed problems in supply chains, for example in the context of the situation in the Middle East. In addition to the negative impact on economic performance, supply-side problems would create additional inflationary pressures. These could also be triggered by a rise in energy commodity prices in the event of an escalation of geopolitical tensions, or by the introduction or increase in tariffs or other barriers to foreign trade. Given the significant trade links between the Czech and German economies, we also consider structural problems and weak economic growth in Germany to be a downside risk to the forecast. The persistence of price growth in services and the level of inflation expectations are also risks for the Czech economy. Economic growth is supported by the labour market participation of refugees from Ukraine, and the full use of their human capital could boost labour productivity.

Main macroeconomic indicators:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2024 | 2025 | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Current predictions | Past prediction | |||||||||

| Nominal gross domestic product | CZK billion, b.c. | 5 889 | 5 828 | 6 308 | 7 050 | 7 619 | 8 007 | 8 431 | 7 988 | 8 410 |

| growth in %, b.c. | 7,5 | -1,0 | 8,2 | 11,8 | 8,1 | 5,1 | 5,3 | 4,8 | 5,3 | |

| Real gross domestic product | growth in %, s.c. | 3,6 | -5,3 | 4,0 | 2,8 | -0,1 | 1,1 | 2,3 | 1,1 | 2,5 |

| Household consumption | growth in %, s.c. | 3,1 | -6,4 | 4,2 | 0,5 | -2,8 | 1,8 | 3,4 | 1,9 | 3,7 |

| Government consumption | growth in %, s.c. | 2,6 | 4,1 | 1,5 | 0,4 | 3,4 | 3,8 | 1,8 | 3,7 | 1,8 |

| Gross fixed capital formation | growth in %, s.c. | 7,5 | -4,8 | 6,7 | 6,3 | 2,5 | -0,1 | 2,8 | 0,9 | 3,6 |

| Contribution of net exports to GDP growth | p.b., s.c. | 0,1 | -0,6 | -2,8 | -0,3 | 2,6 | 0,7 | -1,3 | 0,9 | -1,3 |

| Contribution of inventory change to GDP growth | p.b., s.c. | -0,4 | -1,2 | 2,8 | 1,2 | -2,7 | -1,1 | 0,9 | -1,6 | 0,7 |

| GDP deflator | growth in % | 3,8 | 4,5 | 4,0 | 8,7 | 8,1 | 4,0 | 3,0 | 3,7 | 2,7 |

| Consumer price inflation rate | diameter in % | 2,8 | 3,2 | 3,8 | 15,1 | 10,7 | 2,4 | 2,3 | 2,4 | 2,3 |

| Employment (national accounts) | growth in % | -0,1 | -2,3 | 1,0 | 1,0 | 1,0 | 0,3 | 0,2 | 0,3 | 0,2 |

| Unemployment rate (LFS) | diameter in % | 2,0 | 2,6 | 2,8 | 2,2 | 2,6 | 2,6 | 2,5 | 2,6 | 2,5 |

| Wages and salaries (domestic concept) | growth in %, b.c. | 7,9 | 0,4 | 7,2 | 9,1 | 7,7 | 6,4 | 6,3 | 6,2 | 6,3 |

| Current account balance | % HDP | 0,3 | 1,8 | -2,1 | -4,7 | 0,3 | 1,0 | -0,2 | 1,4 | 0,0 |

| General government balance | % HDP | 0,3 | -5,6 | -5,0 | -3,1 | -3,8 | -2,8 | -2,3 | -2,8 | -2,3 |

| General government debt | % HDP | 29,6 | 36,9 | 40,7 | 42,5 | 42,4 | 43,4 | 44,3 | 43,9 | 44,8 |

| Prerequisites: | ||||||||||

| Exchange rate CZK/EUR | 25,7 | 26,4 | 25,6 | 24,6 | 24,0 | 25,1 | 25,1 | 25,1 | 24,9 | |

| Long-term interest rates | % p.a. | 1,5 | 1,1 | 1,9 | 4,3 | 4,4 | 4,0 | 3,7 | 3,9 | 3,5 |

| Brent crude oil | USD/barrel | 64 | 42 | 71 | 101 | 82 | 81 | 73 | 81 | 72 |

| Euro area GDP | growth in %, s.c. | 1,6 | -6,2 | 6,3 | 3,6 | 0,5 | 0,7 | 1,0 | 0,8 | 1,2 |

Note: Comparison with the November 2024 Macroeconomic Forecast of the Czech Republic of the Ministry of Finance of the Czech Republic.

Source: CNB, CSO, Eurostat, U.S. Energy Information Administration. Calculations and forecasts of the Ministry of Finance of the Czech Republic.

The January Macroeconomic Forecast of the Czech Republic will be discussed by the Committee on Budgetary Forecasts on 10 February 2025. As this forecast does not enter into the budgetary process, the Committee does not examine it.

MINISTRY OF FINANCE OF THE CZECH REPUBLIC/ gnews.cz - RoZ

ILLUSTRATIVE PHOTO - pixabay