Overview of the latest economic events in the Czech Republic

According to the World Bank, FDI inflows to the Czech Republic in 2023 will amount to approximately 2.4 % of GDP, which represents a decrease compared to the previous year. This trend suggests the need to strengthen the investment environment and attract new foreign investors.

According to the Ministry of Finance, the Czech economy is expected to grow by 2 % in 2025, with household consumption being the main driver of growth. Inflation should remain stable, which should support real household incomes.

The Ministry of Finance predicts that the average wage in the Czech Republic will reach almost CZK 50,000 per month in 2025, an increase of 5.5 to 6 % compared to the previous year. This growth is driven by companies' efforts to attract and retain skilled workers.

Foreign investment

In May 2021, Act No. 34/2021 Coll., on Foreign Investment Screening, came into force, which sets out the rights and obligations of foreign investors and establishes an investment screening mechanism to protect national security and public order.

According to the World Bank, FDI inflows to the Czech Republic in 2023 will amount to approximately 2.4 % of GDP, which represents a decrease compared to the previous year. This trend suggests the need to strengthen the investment environment and attract new foreign investors.

Wage growth, which is expected to reach up to 6 % in 2025, raises firms' costs and may affect the attractiveness of the Czech Republic for foreign investors, especially in industry and logistics.

Significant events outside the Czech Republic with global impact

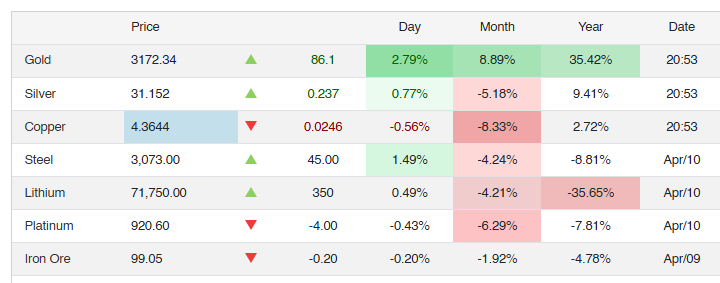

Global financial markets experienced significant fluctuations in response to the threat of new tariffs from the US against China. President Donald Trump has threatened to impose additional 50% tariffs if China does not back down from its retaliatory measures. These moves have sparked fears of a deepening trade war and its impact on the global economy.

Billionaire investor Bill Ackman has called for a temporary halt to the implementation of former President Donald Trump's newly proposed tariffs, warning of the potential serious impact on the global economy. Ackman suggested delaying the tariffs for 30 to 90 days to reduce economic risks.

After previous losses, global financial markets saw a recovery on April 8, 2025. The S&P 500 index rose by 3.7 %, the Dow Jones by 1,363 points and the Nasdaq by 4.2 %, indicating some investor relief despite continued trade tensions.

gnews.cz - GH