Overview of the latest economic events in the Czech Republic

In particular, the investment company EP Global Commerce (EPGC), owned by Czech billionaire Daniel Křetínský and Slovak investor Patrik Tkáč, announced that it plans to delist the shares of German company Metro AG. The strategic move is aimed at streamlining Metro AG's operations and strengthening its market position. The Prague Stock Exchange experienced a day with moderate activity. The PX index remained relatively stable, with minor fluctuations observed in individual sectors. The financial sector maintained its performance, while the energy sector recorded slight gains, attributed to rising energy prices. Overall trading volumes were in line with recent averages, indicating stable investor interest. Domestically, the Czech Statistical Office reported a 4.6 % year-on-year increase in retail sales last year, signalling a recovery in consumer spending. This growth reflects renewed consumer confidence and economic recovery.

In addition, the government is considering measures to address rising energy costs to mitigate the impact on households and businesses. Internationally, the Czech company F.H. Prager, known for its artisan ciders, has announced a rebranding initiative. Starting in 2025, the company will go by the name Prager's and plans to expand its product line and enter new markets. The company aims to nearly double its turnover, reflecting its ambitious growth strategy and commitment to building a stronger international presence. In 2024, the number of corporate bankruptcies in the country reached 686 cases, reflecting a 5% year-on-year increase. The number of businesses filing for insolvency also increased, reaching 1,082, reflecting a 3% increase from 2023. These figures highlight the increasing financial pressures on Czech businesses as economic conditions evolve.

Foreign investments - trends and interesting facts

Czechoslovak Group (CSG), owned by Czech businessman Michal Strnad, has completed the acquisition of Kinetic, a major US manufacturer of ammunition for small arms. The move, valued at approximately $2.23 billion, is aimed at strengthening CSG's presence in the US defence market and expanding its manufacturing capabilities. Energy company EPH, led by Czech billionaire Daniel Křetínský, has finalised an agreement to buy the Italian group Enel's 50% stake in their joint holding company, which owns a majority stake in Slovak electricity producer Slovenské Elektrárne. The acquisition is expected to strengthen EPH's position in the Central European energy sector.

Significant events outside the Czech Republic with global impact

The NYSE and NASDAQ saw a slight decline, influenced by renewed concerns about a possible interest rate hike in the US. Meanwhile, European markets such as the Frankfurt DAX and the London Stock Exchange (LSE) struggled to maintain stability amid uncertainty surrounding trade policy. In Asia, Japanese and Chinese markets remained volatile due to continued economic adjustments in the Chinese industrial sector. For the Czech Republic, these fluctuations could impact export demand and investor confidence and would require local companies to navigate the potential volatility of international trade. The Czech government continues to strengthen diplomatic and economic relations with strategic partners. Recent meetings with European Union representatives have focused on new trade regulations and investment protection that could affect Czech exports.

In addition, Czech officials are actively negotiating with Asian business partners to expand technological and manufacturing cooperation. These developments are expected to strengthen the country's position as a competitive player in global trade. In the logistics sector, European companies are adjusting their supply chain strategies due to rising energy costs and trade constraints. The Czech Republic, which is heavily dependent on industrial exports, is following these developments closely, especially in the context of the slowdown in the German economy, which may affect Czech industrial production. The world energy market remains volatile and rising oil and gas prices are raising concerns about inflation. The Czech government is exploring measures to mitigate energy costs for businesses and households to ensure the resilience of the economy in a changing global energy policy environment.

Impact on the Czech economy

The recent instability on world stock markets, especially in Germany and the USA, poses a challenge for the Czech economy. Given the weaker performance of the DAX index and concerns about rising interest rates in the US, Czech exporters face weaker foreign demand and rising financing costs. The government is assessing possible adjustments to economic policy to support key sectors affected by external volatility. The delisting of Metro AG from EP Global Commerce, owned by Czech billionaire Daniel Křetínský, shows the growing influence of Czech investors in the restructuring of European companies.

Similarly, Czechoslovak Group's acquisition of Kinetic in the US defence sector expands the country's industrial reach. Politicians aim to use these international successes to attract more foreign investors to the Czech market. With European gas supplies running out, the Czech government is assessing strategies to prevent a price spike that could hurt businesses and consumers. Politicians are exploring alternative suppliers and subsidies to prevent inflationary disruption to the economy.

Current exchange rates according to the CNB and Google Rates

| Currency | Czech National Bank exchange rate (CZK) | Google Rate (CZK) |

|---|---|---|

| EUR | 25.135 | 25.1827 |

| USD | 24.129 | 24.2202 |

| PLN | 5.984 | 5.9926 |

| HUF | 0.06191 | 0.062 |

| GBP | 30.242 | 30.2808 |

| CHF | 26.75 | 26.8627 |

| CNY | 3.318 | 3.3307 |

| JPY | 0.15782 | 0.1588 |

| RUB | N/A | 0.2471 |

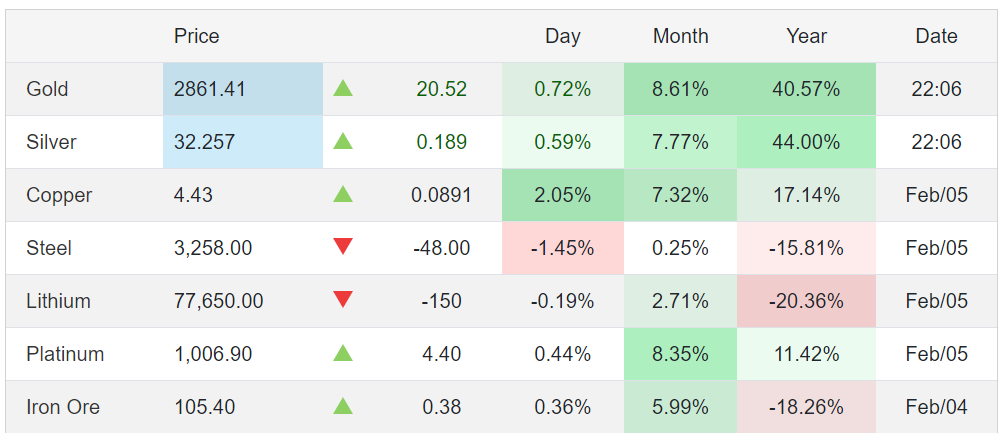

Source about precious metals and Bitcoin: tradingeconomics.com

GH