Welcome back to China Insights Weekly. Here are some of this week's key points:

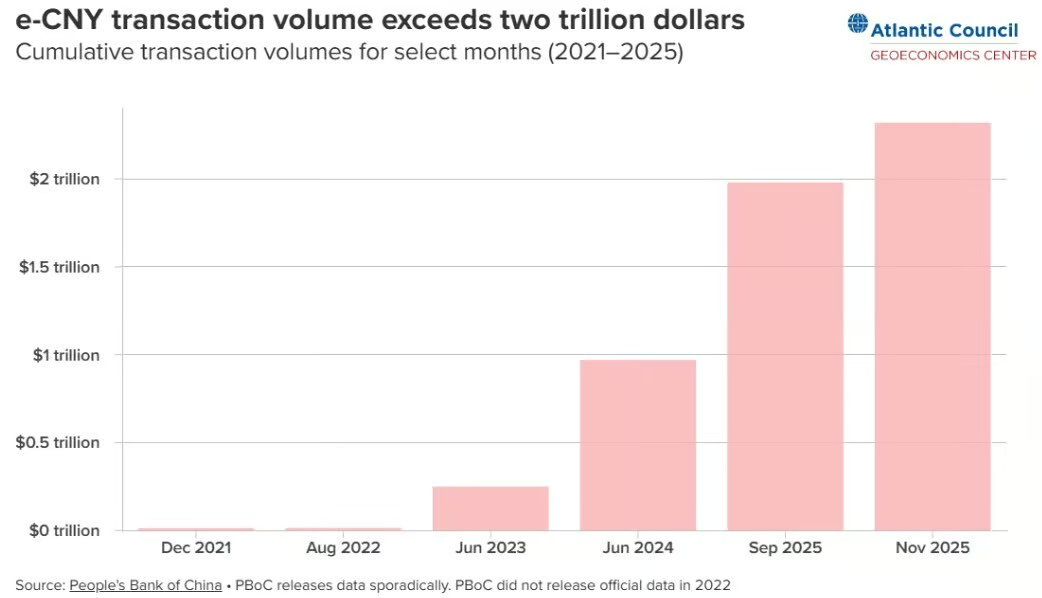

- Using the Digital Yuan in cross-border transactions is growing rapidly, with a 25x increase in transaction volume from 2022

- Investing in green plastics are moving to China, Europe is losing its flagship project

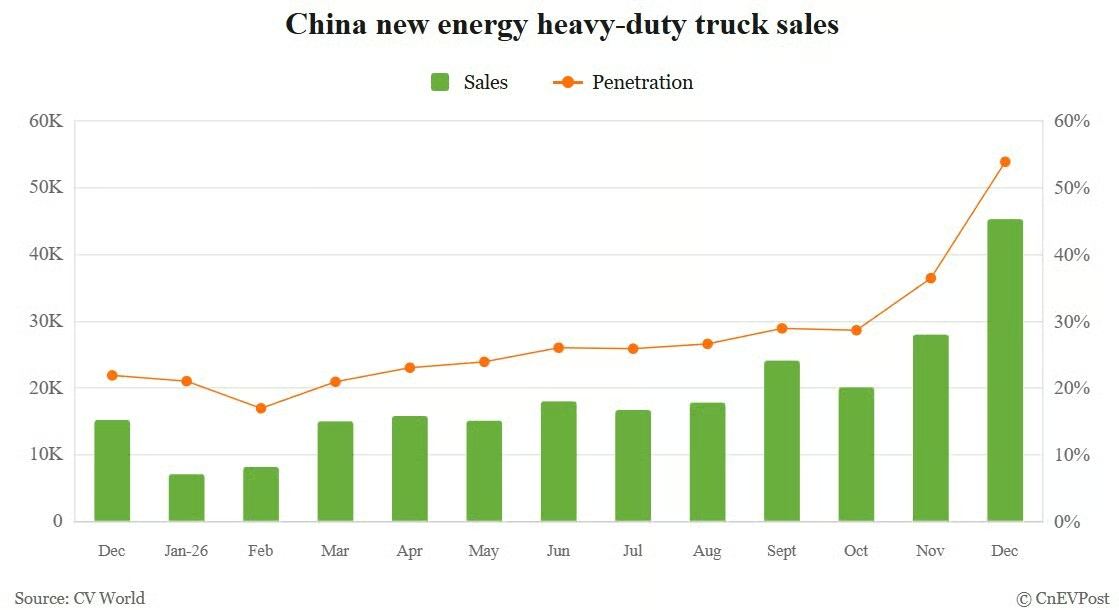

- Electric heavy trucks exceed 50% penetration, number of charging connectors exceeds 20 million

- Chemical plant powered by nuclear energy opens a new chapter, the combination of heat and electricity

Main News

China-led cross-border digital currency platform sees sharp rise

Transactions on China's digital currency platform known as e-CNY have grown to more than US$55 billion, an increase of approximately 2,500 % since the start of 2022. The platform, which is being tested by central banks in China, Hong Kong, Thailand, the United Arab Emirates and Saudi Arabia, has processed more than 4,000 cross-border transactions. It is estimated that e-CNY now accounts for about 95 % of all transactions on the platform. This growth suggests a drive for alternatives to dollar-dependent global payment systems and the gradual expansion of the internationalisation of the yuan through digital infrastructure. The People's Bank of China processed more than 3.4 billion transactions worth approximately US$2.4 trillion, a year-on-year jump of more than 800 %.

China's TCL takes control of Sony's global home entertainment business

Sony Group is transferring control of its home entertainment business, including the Bravia TV brand, to TCL Electronics, a leading Chinese electronics conglomerate. Sony will sell a 51% stake in the division to TCL and the two firms plan to set up a joint venture to start operations in April 2027. The venture will produce TV sets bearing both the Sony and Bravia names, but using TCL's display technology. The move follows a trend of Japanese firms limiting their presence in the low-end consumer electronics segment. TCL shares rose more than 16 % after the announcement in Hong Kong, the biggest intraday gain since April 2025, while Sony shares fell 0.9 % in Tokyo. This strategic shift allows Sony to focus on expanding its intellectual property assets such as anime, movies, music and sports.

Alibaba's open-source Qwen models surpass one billion downloads, rank first globally

Alibaba's Qwen family of open-source big language models has surpassed the one billion total downloads and 200,000 derived models on Hugging Face, the world's largest open-source AI platform. This achievement has propelled Qwen to the position of the most downloaded open-source big model globally, ahead of Meta's Llama series. The number of derived models built on Qwen has exceeded 200,000, making it the first open-source base model in the world to reach this scale. With an average of approximately 1.1 million downloads per day, Qwen's growing influence and adoption among the global development and research communities underscores its significant impact.

Vioneo scraps plans for €1.5bn green plastics plant in EU, opts for China

Vioneo, a subsidiary of the Danish shipping group A.P. Moller-Maersk, has abandoned plans to build a €1.5 billion green plastics plant in Antwerp and instead decided to pursue the project in China. The decision was confirmed after it was reported by Belgian business daily De Tijd. Vioneo wants to produce plastics without fossil raw materials and believes that building in China will be more affordable, reduce CO2 emissions and speed up market entry. China offers better access to green methanol, a key raw material, which would reduce costs and shorten the route to market. The Antwerp project was to be Vioneo's first large-scale plant, with annual production of up to 300,000 tonnes of green plastics for sectors such as healthcare and automotive. The cancellation of the project is a blow to Antwerp's sustainable ambitions.

In December 2025, China reached a milestone when sales of new energy heavy trucks reached a record 45,300 units, accounting for 53.89 % of the total 84,000 heavy truck sales. This was the first time that the penetration rate of new energy heavy trucks in China exceeded 50 %, up by more than 17 % from November. The increase is attributed to front-loaded demand due to the impending expiry of vehicle replacement subsidies and the expected cost of the new energy vehicle purchase tax in 2026. Nevertheless, the full-year penetration rate for 2025 increased to 28.9 %, more than double the 13.61 % in the previous year. Shanghai led in registrations with 34,100 vehicles, followed by Shenzhen and Guangzhou. The economic benefits of the new energy trucks, such as saving about 1.2 million yuan over a 10-year operating cycle compared to fossil fuel vehicles, are cited as a major reason for customers' willingness to pay for them.

By the end of 2025, it will have reached the total number of electric vehicle (EV) charging connectors in China more than 20 million, an increase of 49.7 % year-on-year. Of these, 4.717 million were public charging connectors, with a year-on-year growth of 31.9 %, and 15.375 million were private charging connectors, which grew by 56.2 %. The total installed capacity of public chargers reached 22 million kW, with an average power of approximately 46.53 kW. The growth is driven by the rapid increase in the number of EVs and AI data centers, with China's electricity consumption exceeding 10 trillion kWh for the first time in 2025, a year-on-year increase of 5.0 %. New Energy Vehicle (NEV) production saw electricity consumption growth exceeding 20 % in 2025. Total vehicle sales in China reached 34.4 million units, of which NEVs accounted for 16.49 million vehicles sold, equivalent to 47.9 % of all vehicle sales in China in 2025.

Tomáš Kučera & Yereth Jansen

China-insights.com/gnews.cz - GH